Asset management & investments

Published:

02.04.2025

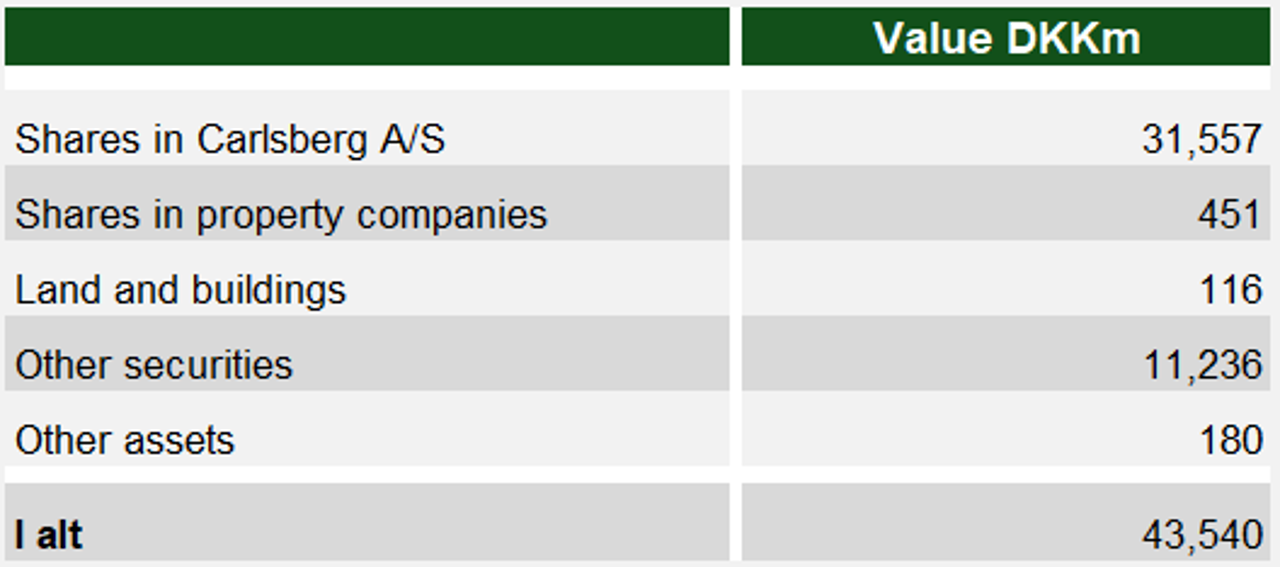

The Carlsberg Foundation’s assets consist of its shareholding in Carlsberg A/S, a property portfolio and investments in securities.

On 31 December 2024, the Carlsberg Foundation held 29.63 per cent of Carlsberg A/S’s share capital, giving it 77.25 per cent of the votes. It also owned a portfolio of properties and a variety of securities invested in accordance with the foundation’s investment policy in different types of assets.

The Carlsberg Foundation’s board sets limits for the scope and risk of the foundation’s investments based on recommendations from the foundation’s investment committee. The foundation uses external asset managers for the individual types of investments. The Quaestor executes the foundation’s investments within this framework.

The Carlsberg Foundation’s assets broken down as follows at the end of 2024:

Asset classes

The Carlsberg Foundation’s holdings of securities other than shares in Carlsberg A/S have grown steadily in recent years, due partly to the foundation’s participation in Carlsberg A/S’s share buyback programmes.

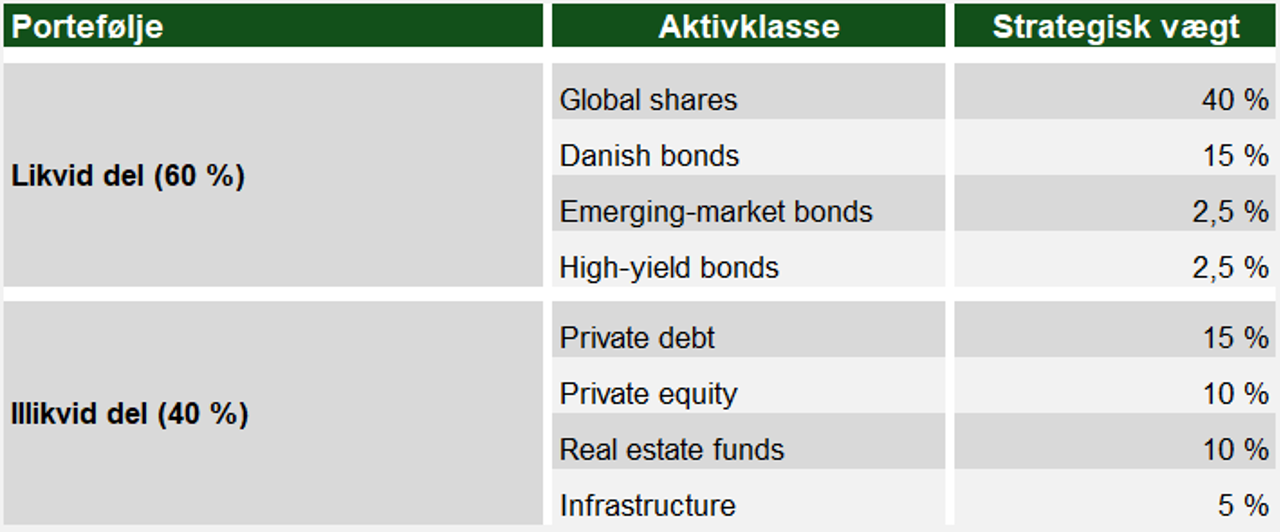

On the recommendation of the investment committee, the foundation’s board has decided on a target allocation of 60 per cent in liquid assets (global equities, Danish bonds, emerging-market bonds and high-yield bonds) and 40 per cent in illiquid/alternative assets (private debt, private equity, real estate funds and infrastructure).

This asset allocation can be illustrated as follows:

Investment policy

The Carlsberg Foundation’s available funds are defined as investments and liquid assets other than shares in Carlsberg A/S. The Carlsberg Foundation invests its available funds in an investment portfolio of around DKK 9 billion in accordance with the foundation’s investment policy.

The purpose of the Carlsberg Foundation’s investment policy is to achieve an attractive long-term risk-adjusted return on the foundation’s available funds that is also balanced in terms of sustainability. This requires focused risk management that takes account of environmental, social and governance (ESG) issues.

The investment policy is also aligned with the Carlsberg Group’s Together Towards ZERO and Beyond sustainability programme.

The Carlsberg Foundation has established an investment committee that monitors and advises on the foundation’s investments.

General approach to investment

In general, the Carlsberg Foundation wishes the investment portfolio to be invested in companies that disclose ESG-related information and work with one or more of the UN’s 17 Sustainable Development Goals. The Carlsberg Foundation expects its chosen asset management partners to be signatories to the UN’s Principles for Responsible Investment or have other external validation of their ESG commitment. The six principles are:

- We will incorporate ESG issues into investment analysis and decision-making processes.

- We will be active owners and incorporate ESG issues into our ownership policies and practices.

- We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- We will promote acceptance and implementation of the principles within the investment industry.

- We will work together to enhance our effectiveness in implementing the principles.

- We will report on our activities and progress towards implementing the principles.

The Carlsberg Foundation believes that investing in companies that have set ESG targets and report on their progress on ESG issues – including respecting international principles for social responsibility – will result in healthier long-term value creation and a higher risk-adjusted return, which also has social benefits.

The Carlsberg Foundation does not carry out its own screening but instead takes as its starting point assessments carried out by recognised rating agencies and exclusion lists used by its chosen asset managers.

Exempted from this policy is the Carlsberg Foundation’s temporary investment of liquid assets that may need to be realised quickly for use in the foundation’s short-term liquidity management or to meet its capital commitments. In this context, the primary consideration is that the investments should be very liquid.

The criteria applied when selecting and monitoring the partners that advise the Carlsberg Foundation and invest on its behalf include expertise in ESG, the sustainable transition and active ownership.

Investment committee

The Carlsberg Foundation has appointed an investment committee to ensure that the foundation’s resources are invested and managed in the best possible way. The committee formulates and maintains an investment strategy that strikes the right balance between risk, return and maturity. The investment strategy has a moderate risk profile and is intended to deliver an appropriate risk-adjusted return. The members of the investment committee are: Peter Løchte Jørgensen (chair) Professor, Department of Economics and Business Economics, Aarhus University Niels-Ulrik Mousten Non-executive board professional Anne Charlotte Mark Non-executive board professional